Life is an amazing journey full of challenges and triumphs. No matter where you are on the journey, preparing can be a key part of success.

Take the time to review your current life insurance coverage or, if you do not yet have life coverage, consider what role it can play in your personal finances.

What are the top three reasons for not owning insurance?

- 78 percent of people who don’t own life insurance say they have other financial priorities.

- 54 percent say they’re not sure how much they need or what type to buy.

- 52 percent say that life insurance is too expensive.

What are the potential benefits of owning life insurance?

Life insurance can play a big role in your overall financial strategy.

- Income support: Your policy may be able to provide financial support to people who depend on you.

- Debt management: Life payouts can be used to pay off your mortgage or your child’s college education.

- Legacy strategy: Life insurance can play a role in estate management and perhaps help you leave a legacy for your loved ones.

Remember, several factors affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

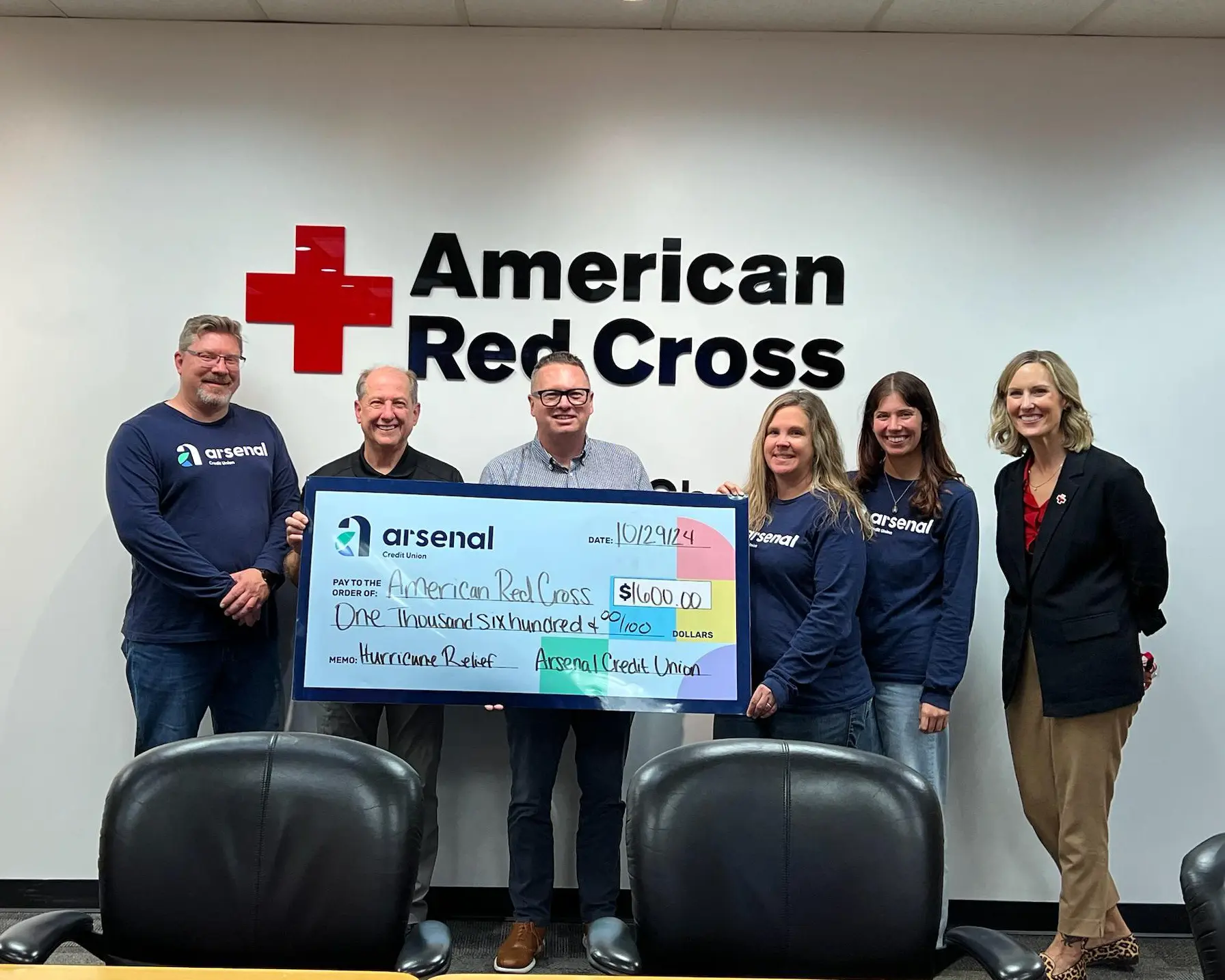

Talk to a financial professional

If you have questions about your coverage, reach out to David Weis, our knowledgeable Financial Advisor available through broker-dealer CUSO Financial Services, LP (CFS)*. Schedule a no-cost, no-obligation appointment with him today to talk about your insurance needs.

Visit David’s website

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The credit union has contracted with CFS to make non-deposit investment products and services available to credit union members. Insurance products and services are offered through Next Financial Insurance Services Company.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright FMG Suite.