Holidays come and go, but debt tends to stick around a little longer. Overspending happens every year during this time, and once the holiday glow is over, the bills start taking over. Get help with credit card debt after holiday spending and get back on track.

Know your budget

If you don’t have a budget, make one. If you do, revisit it. Make a list of who you owe, how much you owe and the interest rate for each. Getting organized is half the battle!

Create a plan to pay down debt

First, be sure to add your credit card payments to your budget in the new year. Next, pick a payment method: The snowball method or avalanche method. Both methods have pros and cons to weigh.

- Snowball method: Put all of your money on paying down the smallest debt first, then the next smallest and so on.

- Avalanche method: Pay the credit card with the highest annual percentage rate first.

The most important thing to do when paying down debt is to stick to your plan. The easiest way to do this is to automate your payments. Set a data for the minimum payments to automatically come out of your account, then set another date later in the month for an extra payment.

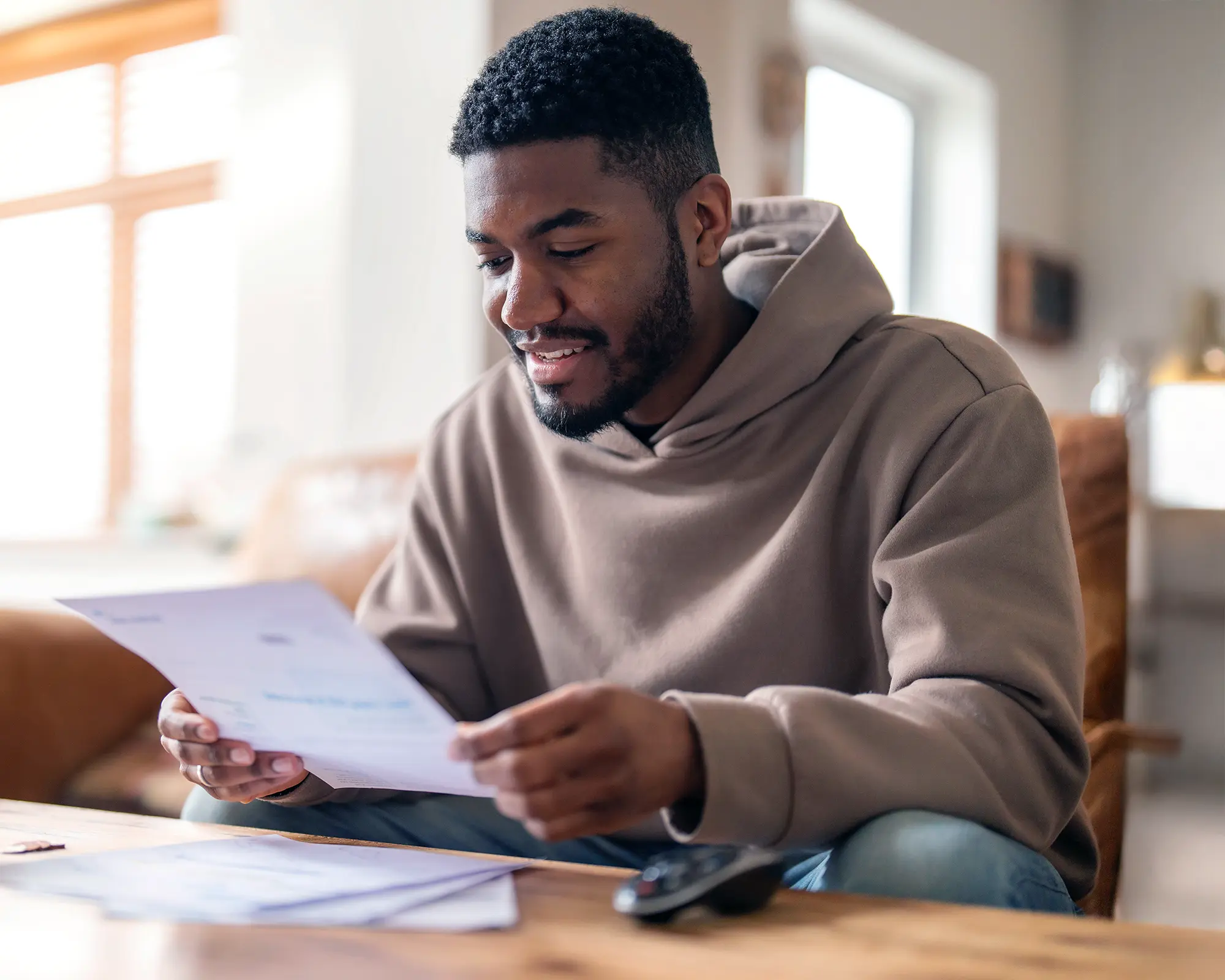

Pay more than the minimum

Typically a minimum payment is only 1 percent of the total, plus interest. If paying only the minimum on $6,300 (the average amount of household credit card debt in America, with an average interest rate of 16 percent), it would take 17 years to pay it down. You’d owe an additional $7,100 in interest.

Doubling the amount each month will result in a little over two years of payments with only $1,100 in interest.

Lower your rate

When you consolidate your high-interest debt from multiple credit cards, you can usually end up paying less interest over the long run. A personal loan is a great way to consolidate at a low rate.

If you own your home, use the equity you’ve built up to consolidate debt at a much lower rate. A home equity loan or line of credit lets you consolidate into an easy monthly payment. Pay no closing costs and borrow up to 100 percent of your equity with us.

Some retail cards carry unexpectedly high rates after the intro period. Need a new card with a lower rate? Switch to a card at Arsenal and transfer the balance for free.