Home$tart is a down payment and closing cost assistance program offered by Federal Home Loan Bank of Des Moines (FHLB) to qualifying first time home buyers through member financial solutions. If you’re asking “Can I buy a house with no money down?” then there are several ways to reach us:

Who can qualify for a Home$tart grant?

The Home$tart program is available to qualifying first time home buyers earning up to 80 percent of area median income for the location of the residence being purchased. Income limits are adjusted based on household size. Home$tart recipients must also:

- Complete a homebuyer education class.

- Qualify for mortgage financing with Arsenal Credit Union.

You must have signed a purchase and sale agreement to enroll in Home$tart.

How much grant money may I receive through Home$tart?

Home$tart participants may receive $15,000 and households completing a home purchase in Hawaii may receive $25,000 in grant funds.

How do I enroll in Home$tart and can I buy a house with no money down?

Arsenal will qualify you for Home$tart and explain the program in greater detail.

Are there any restrictions on the type of home I may purchase?

Home$tart grants may be used to purchase single-family homes, manufactured homes, condominiums and other types of residences. The home you purchase must be used for your primary residence. There are no neighborhood restrictions (i.e., type or location).

Are there restrictions on how the grant may be used?

Home$tart grants may be used for down payment and closing costs for purchase of a home or for repairs in connection with the home purchase.

What happens if I sell my house?

If your home is purchased with Home$tart assistance, it is subject to a five-year deed restriction requiring that you return a portion of the grant if you sell your home within five years. This amount will be prorated based on the length of time you own the home, and the funds will be taken from your sale proceeds. If you sell your home at a net loss or to another low- or moderate-income home buyer or if you lose your home through foreclosure, the prorata amount owed on your grant will be forgiven; in these cases, your title company should contact FHLB Des Moines to request a forgiveness review. However, if you live in the home for at least five years, you never have to repay the grant. It’s all yours!

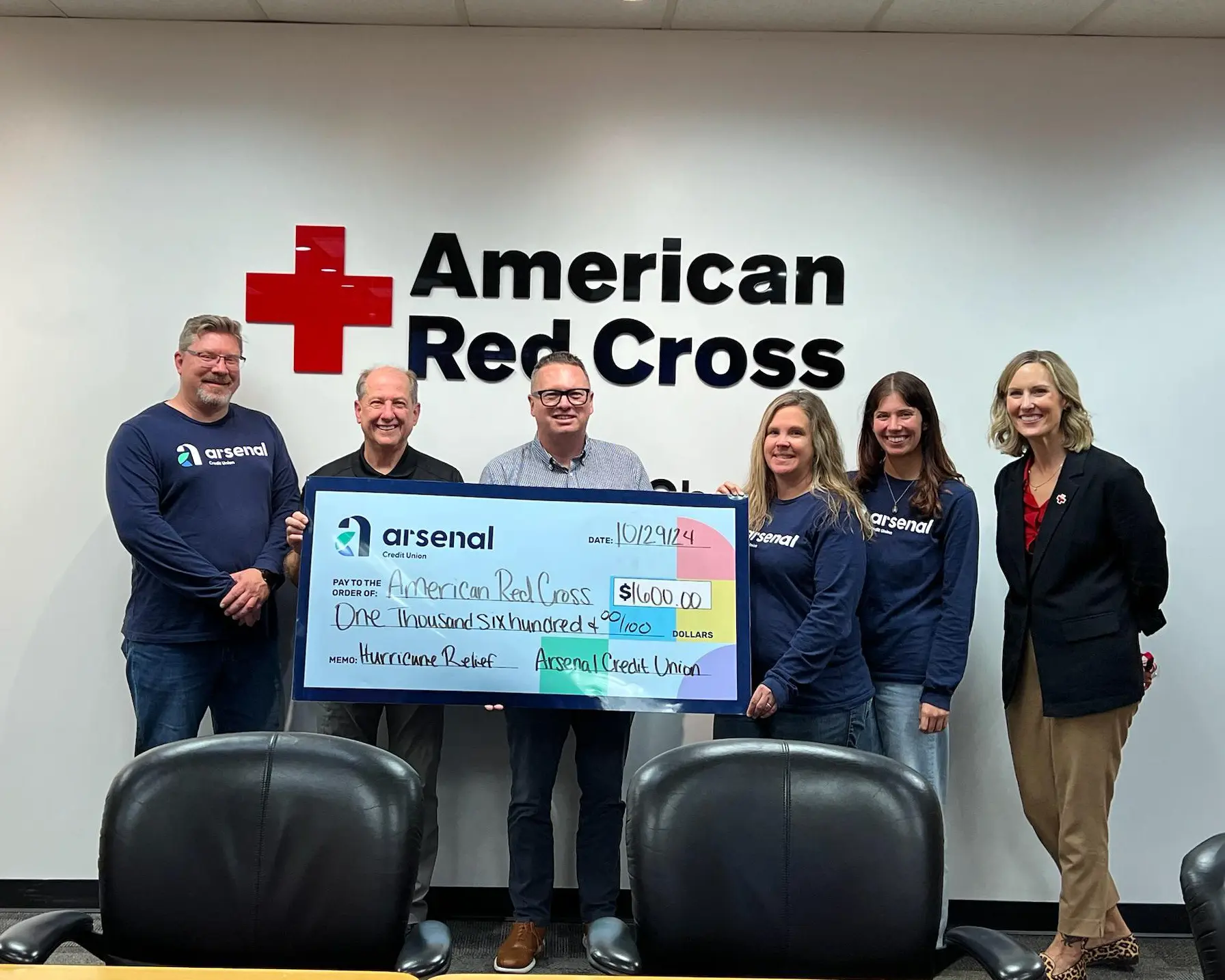

Lending strength

Federal Home Loan Bank of Des Moines is a member-owned cooperative that provides funding solutions and liquidity to nearly 1,400 financial institutions. For a quarter of a century, we have dedicated 10 percent of our net income to creating and preserving homes in our district. Our member financial institutions can receive Affordable Housing Product grants to create livable communities for households with limited incomes.